Content

Create a thorough receipt storage system for compliance and tax returns. These days, software such as cloud accounting apps, POS solutions and invoicing apps are a more broadly accepted method. To perform your own bookkeeping, you’ll first need to understand the core concept of bookkeeping. The principal bookkeeping duties for a small business owner arerecordingandreconciling. Relying on dedicated cloud accounting software is undoubtedly the easiest way to do bookkeeping.

Whether you use Excel, iBank, Mint, QuickBooks, Quicken, or a notebook, staying diligent is the key. You can have the best software around, but if you don’t log your expenses and revenues, you’re nowhere. This is a specifically developed bookkeeping ledger with the bodyworker in mind. This spiral bound book has an easy-to-read, easy-to-use layout that has income and expense categories common to the massage profession. Also included are four envelopes to save business receipts. This book is sure to make tax-time a breeze!

Basic bookkeeping skills you need to learn in your allied health business

Includes 4 large receipt envelopes keep data is in one convenient location. 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. You are responsible for paying any additional tax liability you may owe. A simple tax return is one that’s filed using IRS Form 1040 only, without having to attach any forms or schedules. Only certain taxpayers are eligible.

What is an Independent Contractor? Make Sure You’re Not … – Massage Magazine

What is an Independent Contractor? Make Sure You’re Not ….

Posted: Fri, 02 Dec 2022 08:00:00 GMT [source]

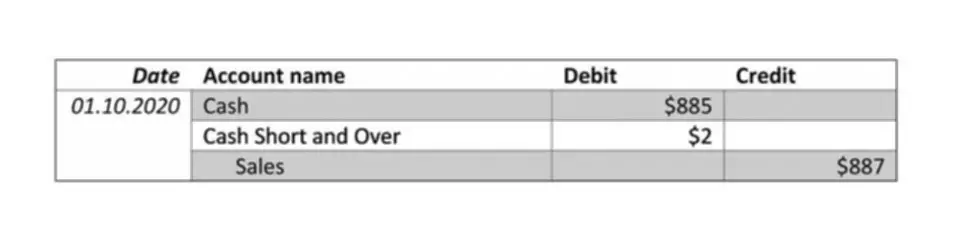

bookkeeping for massage therapists and written evidence, such as logs and notes in your appointment book, are also acceptable. Make a point of recording this information at or about the time of the transaction, and include all relevant information. Expense.Operating expenses are the costs you incur in your day-to-day business, such as rent, utilities, advertising and promotional expenses, and massage supplies, to name a few. What you can claim depends on intent and documentation. Easy-to-use, easy-to-read layout includes income and expense categories specific to the massage and bodywork profession.

PayAnywhere

Their scheduling software can be used for a solo therapist or scaled up to accommodate a multi-therapist practice. It can also manage your appointment schedule if you offer services at more than one location. ClinicSense is an all-in-one software system that is designed to help massage therapists manage their practice. Most of the tools listed below provide other features in addition to their booking function, but not as many features as a complete practice management software like those listed in the previous section. Schedulista provides massage businesses with a convenient online scheduling platform.

- Learn more at the MassageBook website.

- Accountant websites designed by Build Your Firm, providers of CPA and accounting marketing services.

- Automated email marketing and the ability to sell gift certificates online are also available.

- Receipts and written evidence, such as logs and notes in your appointment book, are also acceptable.

Searches 500 tax deductions to get you every dollar you deserve. Create a specific time for bookkeeping each week to ensure you keep on top of it. Reconciliation, or bank reconciliation, is the act of cross checking your sales or expense records against your bank statements.

Expert does your taxes

Jojoba is good for all kinds of work. You just modify the amount and how you warm up the tissue, and it’s really, really great. If you can only have one massage product, this is the one that you want to have. You can have many, but you should also have this one.

Additional terms and limitations apply. Clover offers a user-friendly but powerful payment processing system that is flexible and can be configured to streamline your booking, payment and checkout processes. They have portable and countertop POS systems, virtual terminals, tracking and reporting functions, and tools to enhance customer engagement. Clover integrates with popular bookkeeping software tools QuickBooks and Xero. Pricing for personal services businesses starts at $50 per month, which includes the hardware and software.